Employment & Support Allowance

If you’re ill or disabled, Employment and Support Allowance (ESA) offers you:

financial support if you’re unable to work

personalised help so that you can work if you’re able to

You can apply for ESA if you’re employed, self-employed or unemployed.

You might be transferred to ESA if you’ve been claiming other benefits like Income Support or Incapacity Benefit.

What you'll get

You can get financial support and work-related support through Employment and Support Allowance (ESA).

Financial support

Time period

Circumstance

Weekly amount

First 13 weeks

Under 25

£56.80

First 13 weeks

25 or over

£71.70

From 14 weeks

Work Related Activity Group

Up to £100.15

From 14 weeks

Support Group

Up to £106.50

How much you get depends on your circumstances (eg income) and the type of ESA you qualify for:

contribution-based ESA - usually you get this if you’ve got enough National Insurance contributions (NICs)

income-based ESA - usually you get this if you’re on a low income or you don’t have enough NICs

After 13 weeks of ESA you’ll be put into a group.

Work-Related Activity Group

You have to go to regular interviews with an adviser. The adviser can help with things like job goals, improving your skills, work-related issues.

Benefit sanctions

Your ESA can be reduced if you don’t go to interviews or do work-related activity as agreed with your adviser. The reduction can continue up to 4 weeks after you’ve gone to the interview.

You’ll get a ‘sanction letter’ that says you haven’t gone to an interview and your benefit may be affected. Tell your ESA adviser if you have a good reason for missing the interview.

You’ll get another letter if the decision is made to give you a sanction. Your benefit will only be affected once a decision has been made.

If you get a sanction:

the letter tells you how to appeal

you can also ask for a ‘hardship payment’

Support Group

You don’t have to go to interviews, but you can ask to talk to a personal adviser if you want to. You’re usually in this group if your illness or disability severely limits what you can do.

Contribution-based ESA lasts 1 year if you’re in the Work-Related Activity Group (you may be moved onto income-based ESA after this time).

How you’re paid

All benefits, pensions and allowances are paid into an account, eg your bank account.

Eligibility

You may get Employment and Support Allowance (ESA) if your illness or disability affects your ability to work and you’re:

under State Pension age

not getting Statutory Sick Pay or Statutory Maternity Pay and you haven’t gone back to work

not getting Jobseeker’s Allowance

You can apply for ESA if you’re employed, self-employed, unemployed or a student on Disability Living Allowance.

You may get ESA if you’ve lived or work abroad and paid enough National Insurance (UK or equivalent).

Working and claiming ESA

Usually your ESA isn’t affected if you:

work and earn up to £20 a week

work and earn up to £99.50 a week doing work supervised by someone from a local council or voluntary organisation

work less than 16 hours a week, earn up to £99.50 a week for up to 52 weeks

This is called ‘permitted work’.

You can also do ‘supported permitted work’ for less than 16 hours a week and earn up to £99.50 a week if your illness or disability very severely limits your ability to work.

Supported permitted work is supervised by someone from a local council or a voluntary organisation whose job it is to arrange work for disabled people.

You must tell the Department of Work and Pension (DWP) if you start doing permitted work. They will send you form PW1 to fill in and send back to them.

Any volunteer work you do needs to be reported and can affect your ESA.

Your income and savings

Your income may affect your income-based or contribution-based ESA. Income can include:

you and your partner’s income

savings over £6,000

pension income

You won’t qualify for income-based ESA if you have savings over £16,000.

Work Capability Assessment

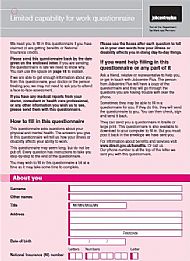

You’ll be asked to fill out the ‘Limited capability for work questionnaire’ during your application. (ESA50)

During the first 13 weeks of ESA you might also have to go to a Work Capability Assessment. This is to see if your illness or disability affects your ability to work, and can include a medical assessment.

You’ll get a letter explaining what to do. Your benefit may be stopped if you don’t go.

Universal Credit

A new benefit called Universal Credit started to be introduced in some areas of the country from 29 April 2013. If you get Universal Credit, it might affect how much you get from other benefits.

How to claim

The quickest way to apply for Employment and Support Allowance is by phone.

Contact centre numbers

Telephone: 0800 055 6688

Textphone: 0800 023 4888

Welsh language telephone: 0800 012 1888

Monday to Friday, 8am to 6pm

You can also post form ESA1 to your local Jobcentre Plus office. The interactive version of form ESA1 can be filled out on a computer.

If your already in Receipt of ESA and would like information or help regarding your claim please call the DWP on

0845 608 8575

(information From Gov.uk website no infringement intended)